Motilal Oswal

Motilal Oswal is a Mumbai-based full-service broker, started by Ramdeo Agarwal in 1987. It is a reliable name in the financial sector for services like retail & institutional broking, wealth management, private equity, home finance, investment banking, currency and commodity broking.

They allow you to trade and invest in equity, commodity, currency, derivatives, bonds, mutual funds and IPOs listed on NSE, BSE, MCX, NCDEX, and MCX-SX.

Motilal Oswal Financial Services (MOFSL) offers a wide range of services such as Retail & Institutional Wealth Management. Motilal Oswal provides in-depth research-based advisory and insights on market movements to its 10 lakhs+ customers and assists them through its 2200+ branches across India.

Motilal Oswal is a Mumbai-based full-service broker, started by Ramdeo Agarwal in 1987. It is a reliable name in the financial sector for services like retail & institutional broking, wealth management, private equity, home finance, investment banking, currency and commodity broking. They allow you to trade and invest in equity, commodity, currency, derivatives, bonds, mutual […]

Motilal Oswal is a Mumbai-based full-service broker, started by Ramdeo Agarwal in 1987. It is a reliable name in the financial sector for services like retail & institutional broking, wealth management, private equity, home finance, investment banking, currency and commodity broking. They allow you to trade and invest in equity, commodity, currency, derivatives, bonds, mutual […]- Dedicated research team & provide constant updates of market research and upcoming trends.

- 30+ Years of Service

- Strong customer Support & Offline Presence

- Multiple tools for trading & investment

- Best in Class Investment Products across various Asset Classes

- Complex & High Brokerage Charges

Specification: Motilal Oswal

| Segment Wise Broekerage | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||

| Account Charges | ||||||||||||||

| ||||||||||||||

| Specification | ||||||||||||||

| ||||||||||||||

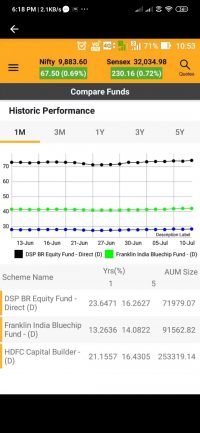

Trading Platform

MO Investor (Mobile & Web)

This trading platform is designed to make it easy to invest in assets like shares and mutual funds. This app is very useful for an investor. We liked the modern look of the interface.

It has an intuitive UI and 24*7 chatbot for resolving any query. You can access the platform via a web browser or downloading it on your computer or phone. The mentioned features in the platform give it an edge over the others.

- Intuitive UI

- Algo-based Products

- 24*7 Chatbot

- Application hangs

- Problems in Charting and Data display

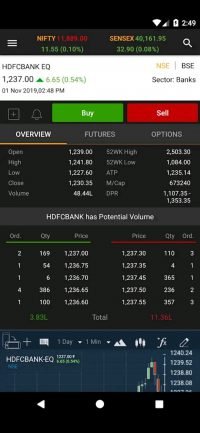

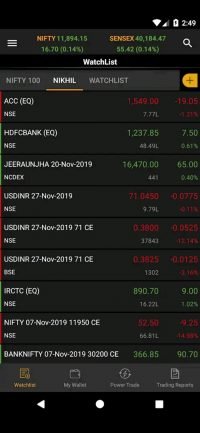

MO Trader

The mobile-based trading application is available on Google Playstore and has a 3.9-star rating. It is equipped with algorithm-based products like trading guide signal, Option writer and Option decoder for better insights and seamless trading and management.

The app provides market screeners to view and buy trending stocks and functionality to execute multiple orders with a single click to save time.

- User-friendly

- Market Screener Available

- Algo-based Products

- Problems in viewing charts

- Hang issue during volatile days

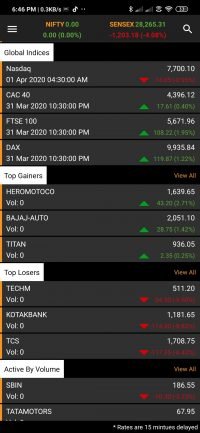

Desktop Terminal

It comes with all the charting tools and a 1-sec refresh rate for tick-by-tick data updates. You can review your portfolio, create watchlists of all the listed assets and analyze streaming quotes. With a trade guide signal, you can detect trends and get auto-generated buy/sell ideas.

Smartwatch

It is India’s first smartwatch app in the stock market industry. But, we cannot place an order through this app. This app allows you just to stay informed with all real-time streaming quotes, indices and important market updates. You can analyze your portfolios and track open positions.

Fee

Account-Related Charges

Motilal Oswal has customized brokerage schemes, so the charges related to the account depend on the scheme that you choose while opening an account. Usually, Motilal Oswal Broker charges a one-time fee of Rs.600 for opening Demat & trading accounts. There are no annual fees (Zero AMC Charges) to keep the account active.

| Account Head | Fee |

|---|---|

| Trading account opening charges | Rs. 600 |

| Demat account opening charges | Free |

| Trading annual maintenance charges | Free |

| Demat annual maintenance charges | Rs. 300-500 per annual |

Brokerage

Motilal Oswal Stock Broker offer 3 brokerage plan. Which are slightly different from one another. You can choose any brokerage plan depending upon your investment/trading profile.

1Motilal Oswal Default Brokerage Plan

Motilal Oswal Default Brokerage Plan

Segment Brokerage Equity Delivery 0.50% Equity Intraday 0.05% (both side) Equity Futures 0.05% (both side) Equity Options Rs 100/Lot Currency Futures Rs. 20 per lot (both side) Currency Options Rs. 20 per lot (both side) Commodity 0.05% (both side)

If you are a high volume trader, Motilal Oswal offers prepaid brokerage plans in which you pay a one-time fee. This will allow you to trade with low brokerage charges on all kinds of orders. In this plan you have

2Motilal Oswal Value Trading Plan

Motilal Oswal Value Trading Plan

If you are a high volume trader, Motilal Oswal offers prepaid brokerage plans in which you pay a one-time fee. This will allow you to trade with low brokerage charges on all kinds of orders. In this plan, you have 7 schemes to choose depending on your initial investment.

This is a prepaid plan in which you pay a one-time fee for a particular time frame. The amount of fee and brokerage charge is inversely proportional.

3Motilal Oswal Tailor-made plan

Motilal Oswal Tailor-made plan

In this plan, high volume traders can pay a one-time upfront fee while opening an account and enjoy the lowest brokerage charges on all transactions.

Monthly Quarterly Half Yearly Yearly Upfront Fees (in INR) 2500 2500 5000 25000 50000 Validity (in days) 30 90 90 180 365 Account Opening Fee (INR) 0 0 0 0 0 DP – AMC (for 1st Year) Free Free Free Free Free Equity Delivery 0.0025 0.003 0.0025 0.002 0.0018 Equity Intraday 0.0003 0.0003 0.0003 0.0002 0.0002 Equity Futures 0.0003 0.0003 0.0003 0.0002 0.0002 Equity Options 60 70 60 40 50 Currency Futures 0.0003 0.0003 0.0003 0.0002 0.0002 Currency Options 20 20 20 20 20

Margin

In the sections below, we have provided a segment-wise margin snapshot provided by Motilal Oswal Broker.

| Segment | Trading Margin |

|---|---|

| Equity Delivery | 4x |

| Equity Intraday | 20x for Margin+ (Over 140 Stocks), 4x for other stocks |

| Equity Future | Up to 3x for Intraday |

| Equity Option | No exposure |

| Currency Future | NA |

| Currency Option | No exposure |

| Commodity Future | Up to 3x for Intraday |

| Commodity Option | No exposure |

Account Opening

Individuals Citizen of India and resident Indians are permitted to open accounts through Online process. You are required to fill the necessary details and make an online payment.

MOFSL after receipt of the payment towards account opening charges for Trading Account etc shall send the account opening document at the registered E-mail ID furnished by the client.

Then you are is required to upload all documents, records etc. Later on which shall be verified with the originals as stipulated in order to open Demat & trading account with Motilal Oswal.

Motilal Oswal Stockbroker also offers an NRI account opening. We found that NRIs can not open an account with Motilal Oswal Broker through the E-KYC process (Online).

If you are US Person/Resident of Canada /Non-Resident Indian residing in Financial Action Task Force, non-compliant countries and Territories (NCCTs) / overseas Corporate Bodies (OCBs) then you shall be required to opt for Physical KYC process & submit duly signed FATCA Declaration.

Education

Motilal Oswal provides good quality educational resources. has a segment on their website dedicated to teaching beginners as well as experienced traders.

- New to markets: This section covers educational and insightful articles, presentations and e-books for beginners to gain knowledge. They keep updating the articles regularly.

- Experienced Traders: There are no new articles in this section since July 2019. The presentations and e-books were published before 2014, so I can’t say how reliable the content is. Overall, Motilal Oswal Broker Provide ample amount of article on share market covering all basic & few advance chapter related to the stock market.

- Educational Videos: There is a good collection of videos a beginner can watch to gain knowledge on trading and investment basics and how the market works.

- MOSE (Motilal Oswal School of Entrepreneurship): This is an entrepreneurship program in finance delivered by experienced faculty for working and aspiring entrepreneurs. They are providing industry-recognized specialty certification.

Product & Services

Besides the trading Platform, Motilal Oswal has multiple tools & applications to do proper research & portfolio management.

- Trade Guide Signal (Predictive AI Trading): The algorithmic products on their platform help the broker’s research service stand out from the rest. ACE (Advise on Combination of Equities) provides algo-based investment strategy and trade guide signal auto-generates buy/sell ideas based on market trends.

- Robo Wealth Manager: This platform provides portfolio restructuring and asset allocation based on your risk profile. It also provides customized model portfolios based on your budget, trading pattern and risk appetite.

- ACE (Advice on Combination of Equities): It is the algorithm-based investment strategy that offers you a portfolio of growth-oriented stocks. This is helpful for those who want to invest in the best shares without any research. Through the ACE platform, you can swift bets on the best stock for investment.

- Portfolio Snapshot: You get in-depth analysis and display of your portfolio investments based on assets and sectors. With a portfolio optimizer and comprehensive portfolio snapshot, you get the optimized real-time view of your portfolio and compare it with previous ones.

Research & Reports

Motilal Oswal is known for its expertise in stock markets research experience. The full-service broker in-house research team provides regular company reports, sectoral reports, thematic reports and market analysis reports exclusively for its clients.

They have done 30,000+ research reports across 230+ stocks and 21+ sectors covering almost segments. They provide centralized advisory to all its trading clients from the dealing desk based in Mumbai.

We regularly got updates from Motilal Oswal over the mobile trading platform, email & SMS. Along with that Motilal Oswal, MO Investor App has a unique feature to track the Finacial health of your portfolio.

Customer Support

Motilal Oswal Broker customer service is good. They can be contacted via phone, email, branch and contact form embedded over Motilal Oswal Website. provide fast and relevant answers. However, most options are not available 24/7. You can contact Motilal Brokers through below channels:

- Account Opening: If you have specific queries related to account opening. You can contact the support team through:

- Phone: 022-40548383

- Email: info@motilaloswal.com or acopquery@motilaloswal.com

- Call & Trade: You can call on this phone support to place your order calling over 91-022-40548810 /022-62701776.

- Email: If you have queries related to your Motilal Oswal Demat & Trading account then you can call over phone 022-40548000 or 67490600. You can also reach out to them by writing an email to query@motilaloswal.com.

Overview

Among all the full-service brokers, Motilal Oswal is known for its most robust in-depth research in the financial sector. Anyone who needs reliable research reports and assistance in gaining market insights, Motilal Oswal is your answer. But it’s not that simple. If you can afford to pay for that research and profits are higher than what you’re paying for brokerage, only then consider a full-service broker.

Even if someone opts for the prepaid value plans, the lowest the margin goes is 0.25%. Which is still a lot higher than all discount brokers and even many full-service ones.

There are no reviews yet.