Zerodha NRI Demat & Trading Account Opening Process

You can now open an NRI & NRO demat & trading account with Zerodha. Along with all the other documents, you have to also give a copy of the PIS letter that the bank would have given you. One can open both NRE and NRO bank account simultaneously with a bank.

In this case, you have to specify which one of these to be mapped to your trading account. You can map only one of these accounts (NRE/NRO) to your trading account. By mapping your NRE account, you can only trade in the Equity segment whereas, through an NRO account, you could trade in both Equity & Derivative segment. If you wish to map both these accounts for the sake of Equity trading, you’ll have to obtain 2 client IDs from your Zerodha.

Important things to keep in mind

- NRI can trade only delivery based. No intraday trading on equity/stocks allowed.

- NRI can trade only equity and equity F&O. NRIs aren’t allowed to trade the currency or commodity markets in India.

- Stock holding of an NRI can’t exceed 10% in any Indian listed company.

- Zerodha supports bank account only with HDFC Bank, Axis Bank, and Yes Bank to link with your NRE or NRO trading account.

Zerodha NRI Account Opening Documents

You need to send an account opening form along with various documents while opening a Demat & Trading account with Zerodha, mentioned below:

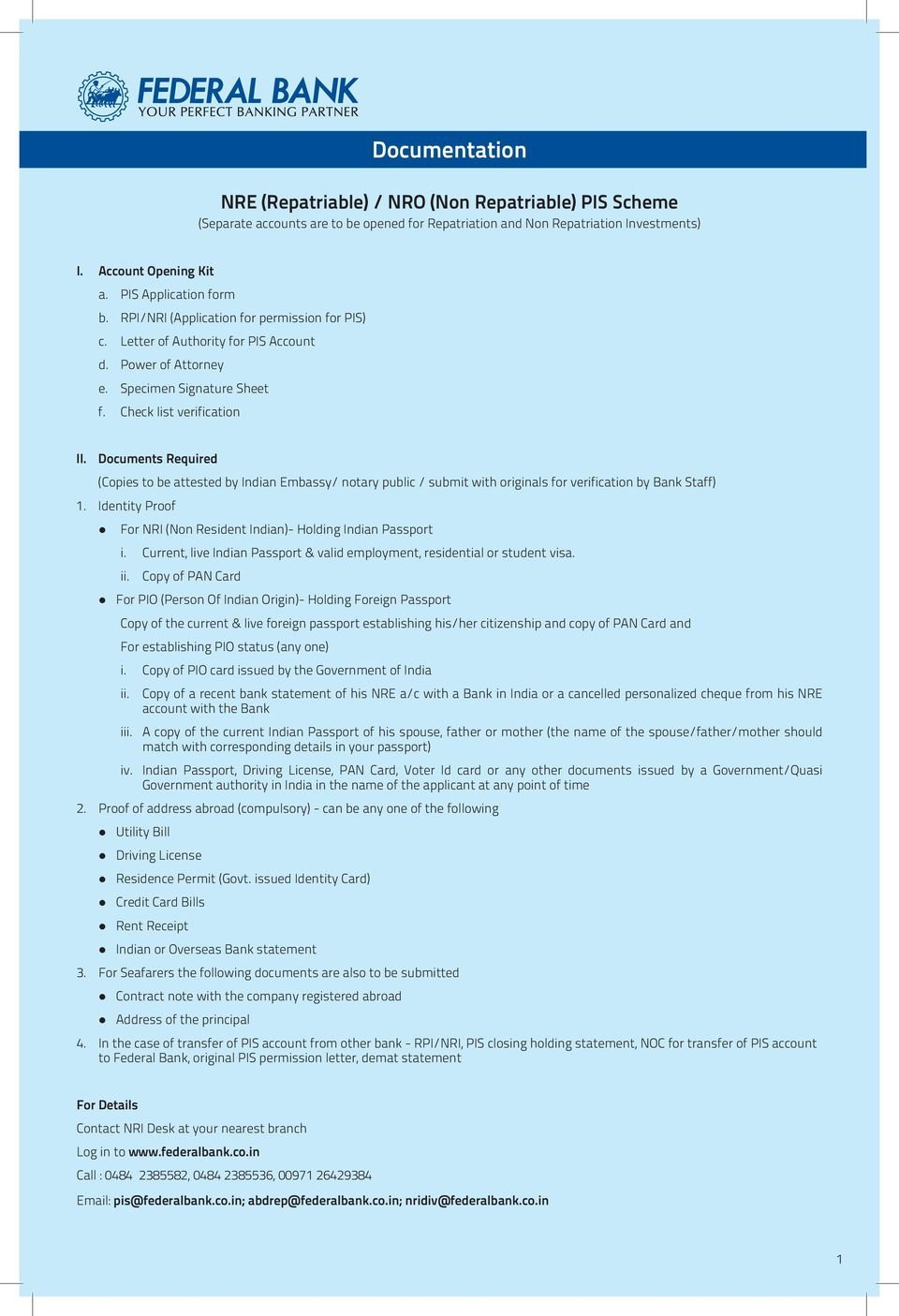

- Copy of PIS permission letter/NRO-Investment account letter

- Copy of FEMA declaration for Zerodha Broking limited and FEMA declaration for Zerodha Securities

- Copy of PAN card

- Overseas address proof – Copy of Driving License/Foreign Passport/Utility Bills/Bank Statement (not more than 2 months)/Notarized copy of rent agreement/Leave & License agreement/ Sale Deed

- Indian address proof, if any

- Passport size photograph

- In case of an Indian Passport: Copy of valid passport with the place of birth as India, Copy of Valid Visa

- In the case of Foreign Passport: Copy of Valid passport, Copy of PIO/OCI card.

- Proof of Bank account (a canceled cheque leaf of your NRE or NRO SB account)

- Declaration of P.O. Box in your residing country

- FATCA Declaration Form

Brokerage & Charges for NRI Account

You will be charged Rs. 500 for NRIs trading & demat account opening. In addition to the account opening, brokerage charges imposed on the consumer are as follows

NRI Brokerage Charges & Tax

- Rs. 100 per order for F&O Trades.

- 0.1% or Rs. 200 per executed order for equity (whichever is lower)

- STT, Transaction charges, GST, SEBI Charges as mentioned here will be applicable

- Stamp duty will be charged as per the state of your correspondence address. If your correspondence address is out of India, you will be charged stamp duty as per Karnataka State.

Zerodha NRI demat & Trading Account Opening Process

In this article below I have tried to simplify what goes into opening an NRI trading & demat account with Zerodha. In this process I have explained investing in the Indian Stock Exchanges through the PIS route.

Total Time:

Zerodha NRI Account Opening

First, you need to signup for the Zerodha account opening so after entering your lead details Zerodha Customer Support will contact you to help in the account opening process. You can sign up for the Zerodha NRI Account opening (Click here to Request Callback).

Opening Saving Bank Account

Only one account can be mapped to your Zerodha Demat & Trading account. By mapping an NRE account, you can only trade in the Equity segment whereas, through an NRO account, you could trade in both Equity & Derivative segment. As a Non-Resident, you can open an NRE or NRO account simultaneously. Currently, Zerodha supports HDFC Bank, Axis Bank, and Yes Bank for NRE/NRO savings account.

Get your Portfolio Investment Scheme (PIS) permission letter

You also required to obtain a permission letter from Reserve Bank of India (RBI) for Portfolio Investment Scheme (PIS) before you open a Demat & Trading Account with Zerodha. You need to approach the bank branch where you have opened an NRI/NRO account to obtain a PIS permission letter from RBI.

Processing for Zerodha NRI Demat & Trading Account Opening

You need to send above mention documents which are required to be sent along with the printed & filled up account opening form while opening a Demat & Trading account with Zerodha. You can request a call back before sending documents to the zerodha office so we can do basic scrutiny and check if all documents are in order, and guide you if there are discrepancies.

You have to courier account opening form along with all required documents to Zerodha head office address as mentioned below:

153/154 4th Cross Dollars Colony,

Opp. Clarence Public School,

J.P Nagar 4th Phase, Bangalore – 560078

Happy Investing!